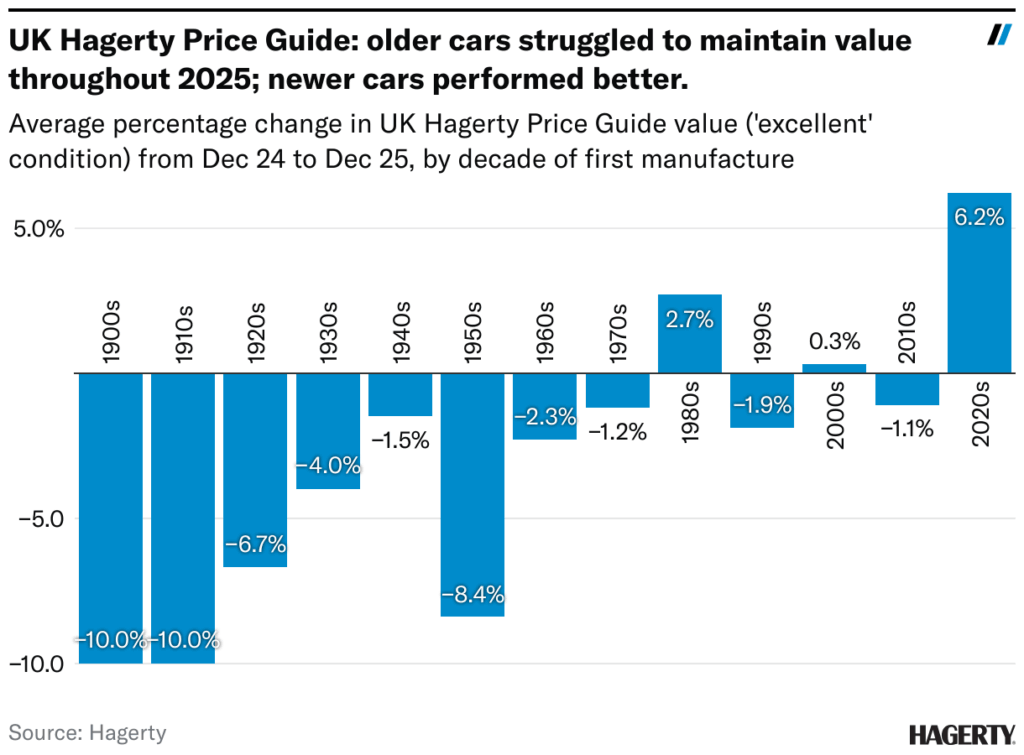

Hagerty UK has revealed its latest UK market picture – and it’s an extension of the trends present in 2024, with a sense of continuing rationalisation after Covid-era highs.

“The boom times of the post-Covid era are now firmly over,” explains John Mayhead, editor of Hagerty Price Guide UK. “Buyers are being much more careful with their money and, as a consequence, nearly 80 percent of values have either dropped or remained static.”

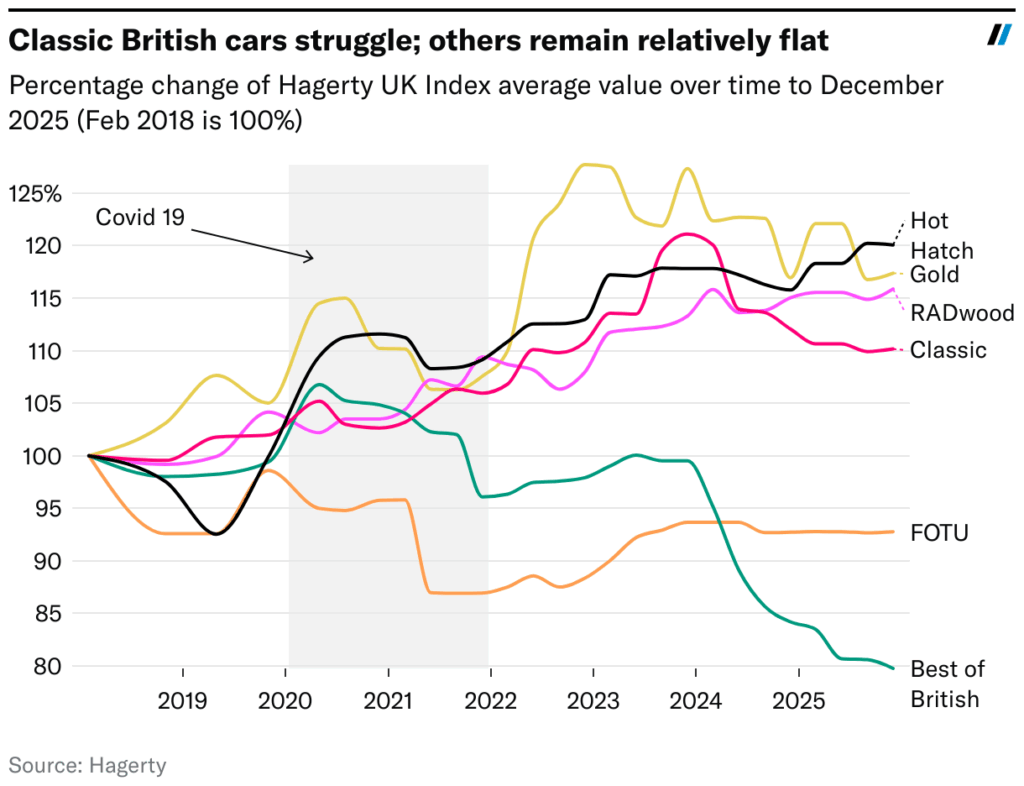

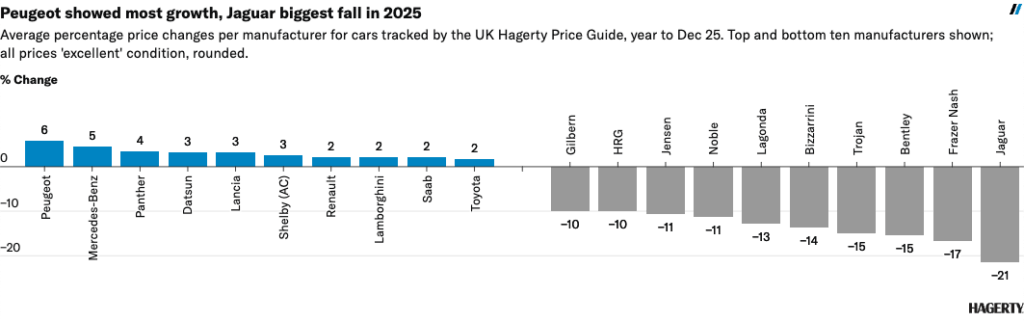

Classic British cars in particular are struggling in the UK market picture, with Hagerty’s specific Best of British index at its lowest level since tracking began in 2018. “Across the entire 3000 models of the Hagerty Price Guide, the story is similar: a list of the manufacturers that have reduced, on average, most in the 12 months to December 2025 shows British brands taking nine of the ten places, with Bizzarrini the only foreign manufacturer making the list,” Mayhead says. Jaguar is the brand that has suffered the most, with Hagerty observing a value decrease of 21.4 percent, which it puts down to the £3.6m reduction in the mean value of the XKSS, and significant value falls for the C-type and D-type.

Only two of UK indices show meaningful growth in the latest UK market picture, according to Hagerty, and both in the modern classic realm – the Hot Hatch (HH – tracking predominantly 1980s and newer performance hatchbacks) and RADwood (RW – tracking 1980s and 1990s cars) indices. However, it was a much older car that showed the largest value increase of any car – the Shelby Cobra Daytona. “[This was] pushed up by a number of significant Cobra sales at Kissimmee and Monterey during 2025, and the subsequent change to insured values,” Mayhead adds.

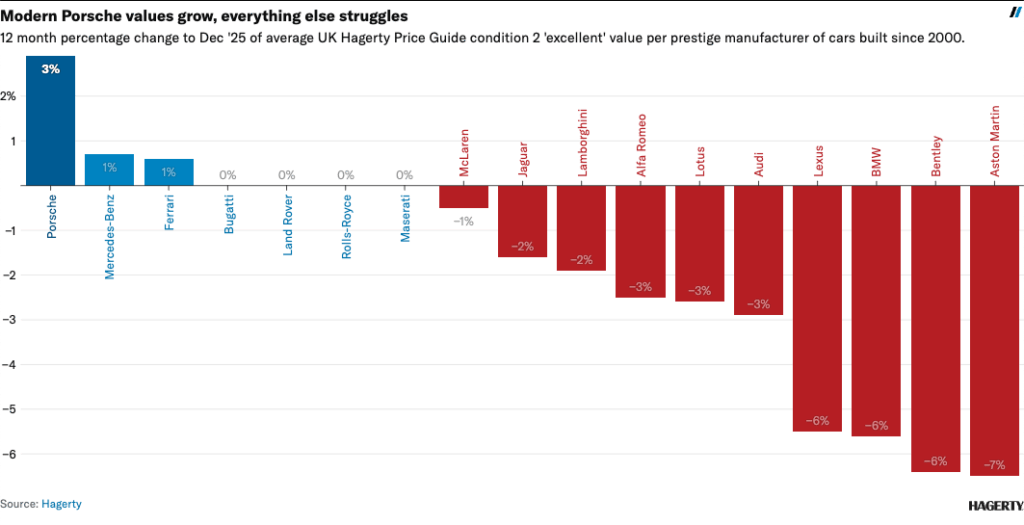

However, even in the modern classic (post-2000) realm there have been issues – just Porsche, Mercedes-Benz and Ferrari have seen their values grow over the past year, with everything else struggling.

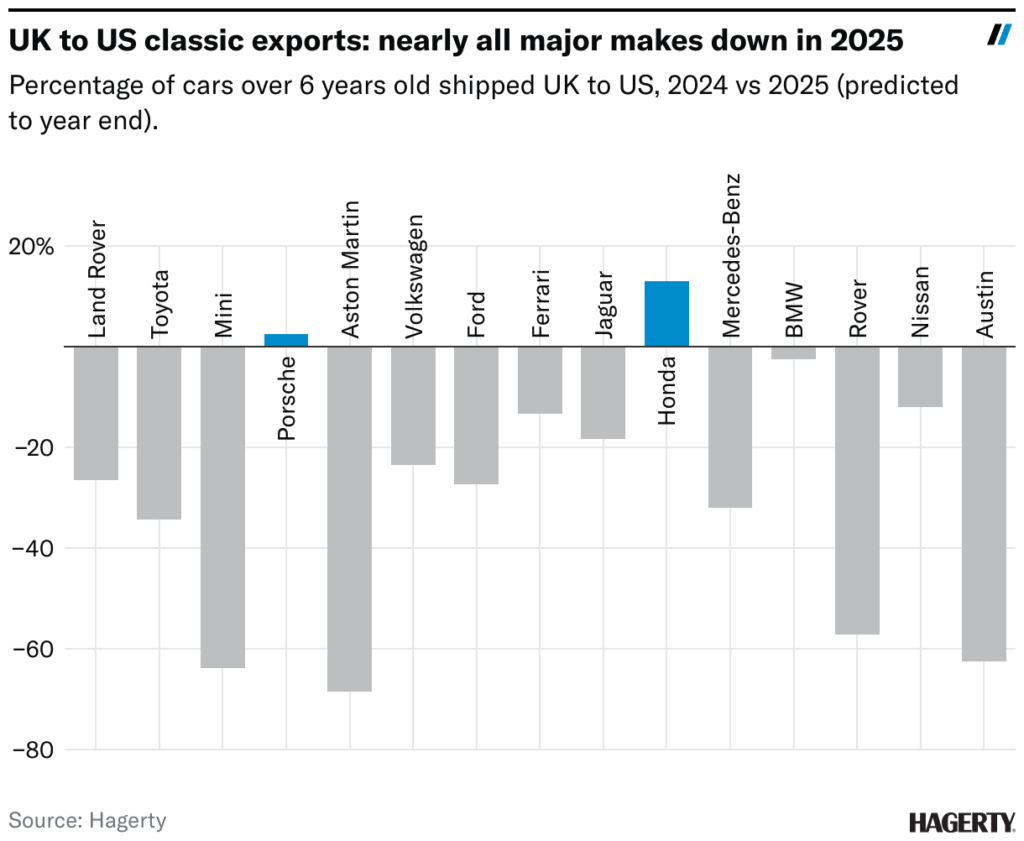

Hagerty reports that the number of cars more than six years old being exported to the US fell to a six-year low in 2025, a reduction of 14 percent compared to 2024. “Of the 15 brands most usually shipped from UK to US, just Porsche and Honda rose, the rest fell. Land Rover remained the most shipped older car from the UK to US, accounting for 24.8 percent of all cars, followed by Porsche (6.7percent) and Toyota (5.4percent),” Mayhead observes. “Uncertainty over tariff regulations may well have affected export rates.”

Moving away from the UK market picture, Hagerty’s analysis notes that of the top ten sales (which we brought you here), the top two sales were in the EU, with two in the UAE and the remainder in the US.

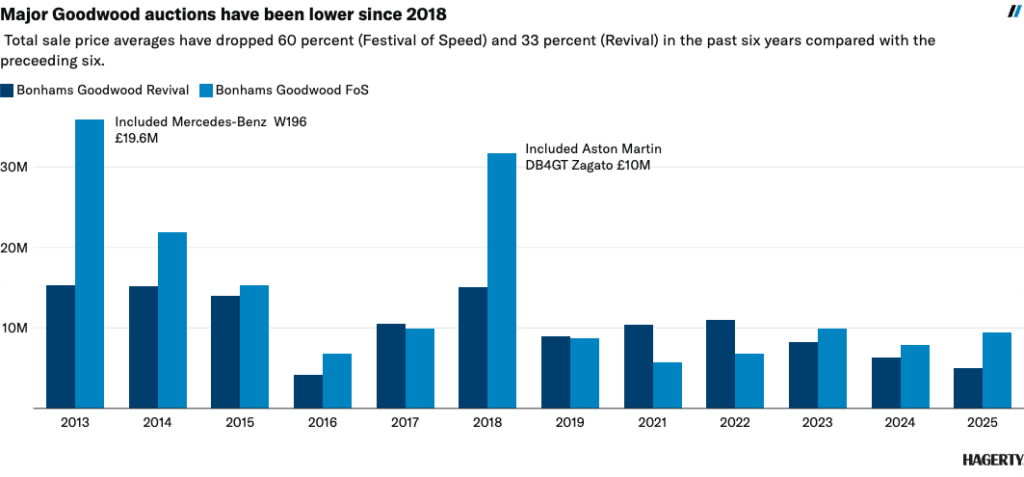

“British auctions at the top end have struggled, with Bonhams Goodwood Revival returning the lowest total since 2016,” Mayhead notes. Although Bonhams has been singled out, other international auction houses have often failed to see the same success in the UK as they do elsewhere, most notably RM Sotheby’s and Gooding-Christies. “It is possible that continued complexity of export requirements post-Brexit, and possibly reduced market confidence here, has pushed major sales overseas.”

In summary, Hagerty UK says that the very best cars still seem to be in demand, at almost every price point in the market, but uncertainty (both domestic and international) seems to have impacted on both sales and exports.

“Older cars, especially classic British cars, have tended to drop in value, but some modern classics are still increasing in price as demand increases,” Mayhead says. “But there hasn’t been a crash; unsustainable post-Covid prices have now returned to a realistic level, and that can be seen as a good thing for the hobby, as it may allow a wider range of cars to be accessible at a lower price point. Events are still thriving, and that’s a great sign.”

More information can be found here.