WORDS: JOHN MAYHEAD

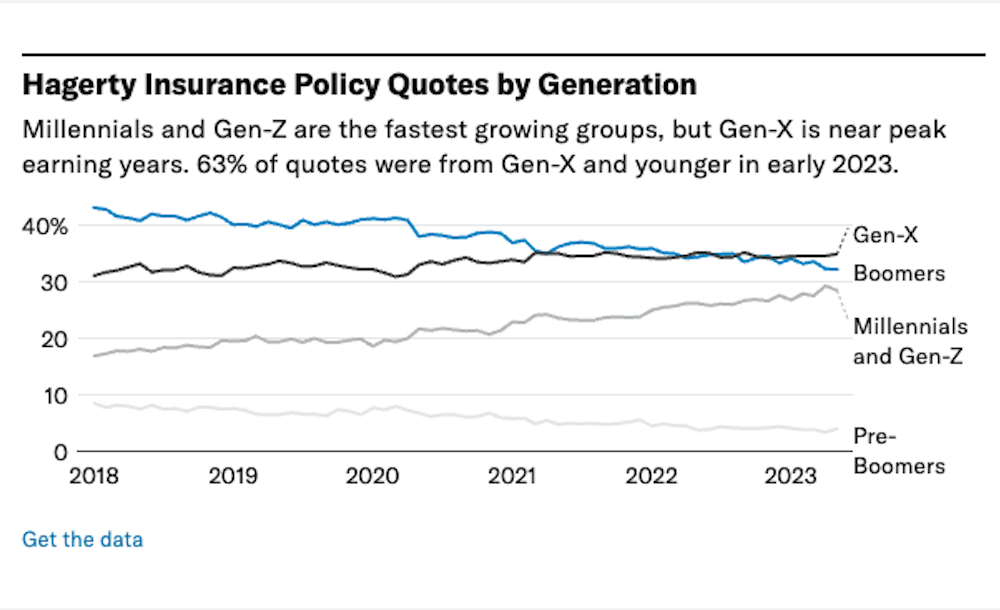

Hagerty’s year-end analysis has identified something that those in the trade have known for some time: younger enthusiasts are entering the market while the older generation are leaving. During 2023, Hagerty’s global quotes have shown a four percent drop in the number of Baby Boomers – born post-World War Two to 1964 – and a rise of five percent in Millennials – born 1980 to 1994. The percentage of those in the middle – Gen X – has not changed at all.

The obvious result of this is that demand for a specific type of car is changing: 1980s and 2010s models have risen fastest in value in this year’s UK Hagerty Price Guide, and those brands that have fallen most include some of the marques best associated with older cars: Bristol, HRG, Frazer Nash and Allard. Subaru, specifically the Impreza, outperformed everything else (note: we’ll analyse the US market in early January 2024).

However, the market is feeling other, more subtle, results of a demographic shift. For anyone who attended either the HCVA or AOHE conferences this autumn, it was obvious that the UK classic car industry is turning a corner, and concerns over climate change, emissions and sustainability are suddenly being taken very seriously. Synthetic fuels in particular are hitting the headlines, with exponents such as William Medcalf racing all his vintage Bentleys on them, Goodwood announcing that the Revival will be run on the same, and various dealers, like Tom Hardman, supplying such fuels to his clients.

“It makes sense from both a business and an environmental standpoint,” Tom told me. “We are a family firm, and we want to make sure that the company and the vehicles we supply are usable for future generations. Our office operates off solar energy and olive kernel fuel. Synthetic fuels will help preserve our culture and heritage, not only from a vintage car perspective but across all aspects of modern life.”

Some of this may be down to synthetic fuels suddenly becoming a realistic prospect, as Guy Lachlan, HCVA sustainability director, explained: “2023 has been a really important year for sustainable fuels, with their presence on the racetrack, in the press and on social media all driving awareness and interest among owners and legislators alike.

“People can now see that net zero liquid fuels are a realistic proposition, and this in turn helps secure a future for classic vehicles, which, of course, rely on access to this new technology if they are to justify a place in tomorrow’s world.”

But with a new generation comes new demands. Another interesting statistic that emerged from Hagerty’s 2023 analysis was that cars with smaller engines have increased in value more than larger ones: on average, everything over 3.0 litres either lost value or remained static in percentage terms. The 2.0-litre and under engines on average gained value. This may reflect belt-tightening, or it could be an acknowledgement that size isn’t everything. We’re entering interesting times.